Do I need Personal Car Insurance on Turo?

No, personal car insurance is not needed to rent out Turo as you can purchase the rental insurance through the Turo app. Turo offers three different levels of insurance protections plans: Basic, Standard and Premium. Both the renter and the host must choose which plan to purchase.

Turo insurance options for the renter:

Turo Basic or Minimum insurance covers protection against theft, vandalism and collision damage and $3000 max out of pocket for vehicle damage or theft.

Turo Standard Insurance protects against theft, vandalism and collision damage and $500 max out of pocket for vehicle damage or theft.

Turo Premier Insurance protects against theft, vandalism and collision damage and their is no out of pocket costs for vehicle damage or theft.

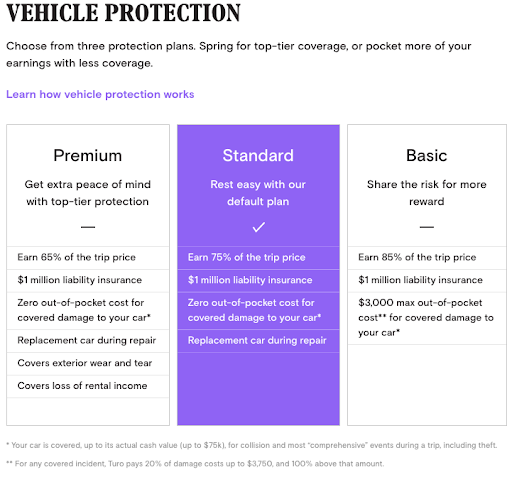

Turo insurance options for the Host:

Turo Basic covers 1 million in liability Insurance and $3000 max out of pocket cost for covered damage to your car.

Turo Standard covers 1 million in liability insurance and zero out of pocket cost for covered damage to your car. Replacement car during repair.

Turo Premium covers 1 million in liability, zero out of pocket costs for covered damage to your car. Replacement car during repair, covers exterior wear and tear, covers loss of rental income.

Turo Insurance Options